Transforming an insurance product into a digital one

The easier it is to buy something, the more the customers. Ingosstrakh, one of leading Russia’s insurance companies, decided to take this rule to its mobile app. What they got, in the end, is IngoMobile – leading insurance mobile service allowing customers to obtain comprehensive car insurance right from their smartphones.

Comprehensive car insurance is one of the main products of insurance companies. This type of insurance is quite profitable for companies, but is associated with large operating costs. This type of insurance requires several meetings with the car owner and the work of field insurance agents, so with such a high cost not all customers end up concluding an insurance contract.

True Engineering and Ingosstrakh have revolutionized the process in which comprehensive car insurance can be obtained from offline to fully online. Now car owners can have their comprehensive car insurance issued to them on their own through their smartphones with IngoMobile, the insurance company’s main app. The solution allows a car to be independently inspected at a convenient time without the need to have to visit an office and or to involve an insurance agent. This saves the customer time while maintaining information reliability on the vehicle.

For the first time, we and Ingosstrakh tested car inspection technology on insurance agents 3 years ago. Since 2015, they have been transferred from cameras and paperwork into a mobile application. The results have put the technology’s effectiveness on display: the percentage of fraudulent transactions has been reduced to a minimum, and the well-thought operation scenario has significantly boosted the overall car inspection quality. Therefore, with the development of the client mobile app, the insurance company decided to extend this experience to its private clients.

The process begins with the clients selecting the applicable conditions and the preliminary insurance cost calculated in the comprehensive car insurance calculator, after which the client can begin the registration process, which includes:

- document recognition

- sequential car photographing using masks

- convenient damage repair and additional equipment scheme

- video chat with underwriting department experts

- payment and receipt of the comprehensive car insurance directly in the app

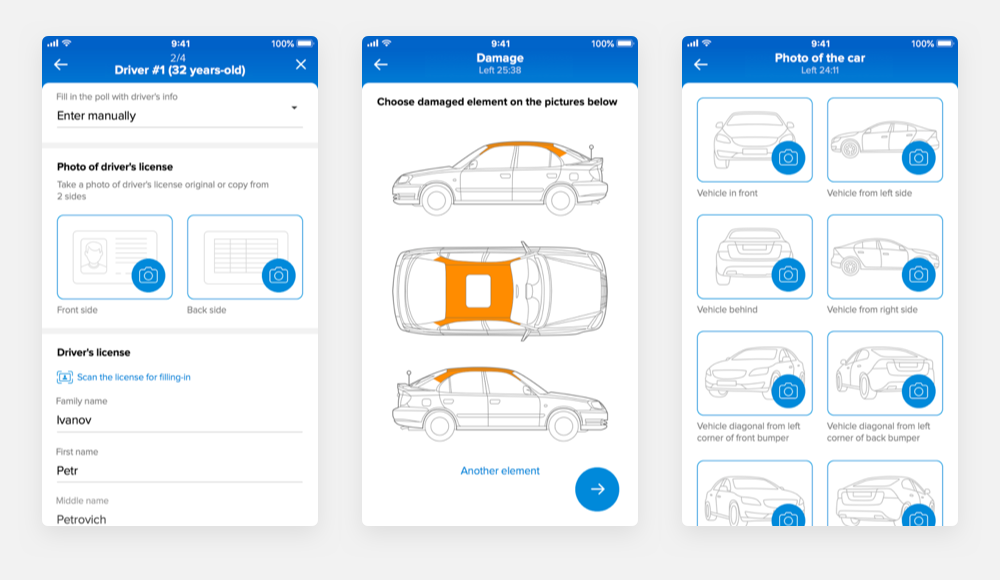

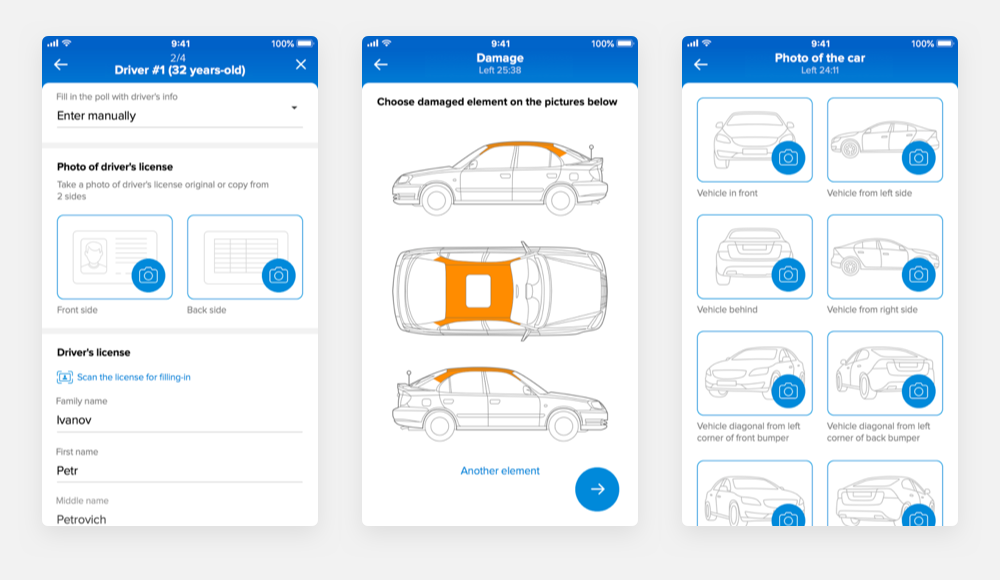

Step 1: upload documents

The data that the client enters in the calculator is uploaded into the application from the server. They are not required to re-enter it.

In the application, the client uploads the following documents on the car: the car title, his driver's license, and his passport. We use document recognition to ensure accuracy and accelerate form fill-out speed. The main passport and driver's license fields are filled in automatically in just a few seconds: date of birth, full name, passport number and series, sex, issuing authority, date of issue, and driver's license number.

The application uses the Smart IDReader document recognition module from Smart Engines. The technology is adapted to work even on basic-level smartphones with low-resolution video cameras.

Step 2: car photographing

In accordance with the strict predetermined procedure, the user inspects the car on his own, photographing it on a smartphone from all the required angles and with the proper level of detail.

Every detail of the car requires mandatory indication. The application carries out the inspection procedure step-by-step and shows you what parts you have to photograph. The photo editor features masks for proper photographing and prompts with examples of what type of photo is expected.

Damage is shown by way of the car’s visual scheme. One can simply choose the detail, form of damage, and take a picture of it.

In order to prevent potential fraud, the amount of time for the inspection is limited to 30 minutes. Pictures are stored in the application in encrypted form. Not only the details of the car, but also the overall view and surroundings of the inspection must be photographed. Furthermore, the geolocation of each photo is recorded to confirm that the pictures are taken at the same place and are of the same car.

We have also implemented a feedback function for inspection and document handling. After the photos of the car and documents are uploaded, Ingosstrakh may send the photos back to be retaken in the event that they do not satisfy the requirements. Communication and interaction take place throughout the registration process place via the application.

After the photos are transferred to the server and approved, the client and an Ingosstrakh operator together pick a convenient time for the video inspection.

Step 3: car video inspection with the help of an operator

Video inspection with an Ingosstrakh operator takes place in real-time mode. The operator guides the process and asks the client to show him the car from every angle.

- The driver chooses where and when is the most convenient time for them to conduct an inspection, since there is no need to go visit the insurance company.

- Throughout the video inspection process, the operator compares it to the car photos and asks for a close-up on all the car’s elements that feature defects.

- The operator also discusses the terms of the insurance with the car owner, for example, installment payments or the inclusion of additional options.

The information collected throughout the inspection and photographing the car allows a risk-laden car to be identified and fraud attempts to be exposed. After all the inspections, an individual comprehensive car insurance offer is presented.

Step 4: comprehensive car insurance

The mobile application is integrated with the customer's information and billing system. Thus, the final comprehensive car insurance offer is immediately available for payment in the mobile application. After payment is made, the comprehensive car insurance is automatically issued, which appears in the list of the client’s insurances in the mobile application, in his personal account on the website, and is additionally sent to the client’s email.

Development

As for the second stage, the opportunity has developed for property insurance to be issued using the same technology. Self-serve property insurance has become the second insurance type that has fully transferred into an Ingosstrakh digital format packet service.