Settlement of comprehensive car insurance – right from a mobile app

Even a process so complex as claims settlement can be inserted into a mobile app. We're going to discuss how our developers created a service for VSK that enables reporting and settling comprehensive car insurance losses.

VSK Insurance House has been carrying out insurance activities since February 11, 1992 and currently holds leading positions in the Russian insurance market. The company offers insurance products and services in the areas of marine, aviation, space, cargo, motor, personal, property, life, travel, ritual and medical.

Client’s comfort as the main target

Since its very creation, the VSK app has become a mobile service office for customers. Here they can design and buy an insurance certificate, report an insured event, and get instructions on how to act in unexpected situations.

The company's aim is to free its clients of any need to go to the office at all. This is a mutually beneficial situation: clients can quickly tackle their issues without any red tape, and VSK unburdensits employees from part of the workload.

The comprehensive car insurance loss settlement feature is among the most demanded functions of the app. In the VSK mobile app, the True Engineering developers built a process which is now used by hundreds of clients every month.

Why does it matter?

- The company is digitalizing the settlement process, meaning there are fewer chances for errors, fraud, and other “human” mistakes.

- There is no need to allocate time for meetings with insurance company representatives — the new settlement process only takes half an hour, the client takes the necessary steps themselves when it's convenient for them.

- Clients don't need to travel to any offices; they can prepare and send all the materials to the insurance company themselves — this makes them feel comfortable and confident despite their distress.

- During the pandemic, remote settlement allowed VSK to maintain its pace of development while simultaneously minimizing physical contact between staff and clients.

Clients used to have to wait while company staff recorded and processed information about the incident. Remote settlement allows one to drive to a repair shop practically as soon as the company is contacted.

The settlement process can be launched from the app's very first screen — tap the SOS button or go to the "Cases'' tab. Besides this, the user can go to the list of their certificates to select the appropriate one right away, and start from there.

Creating the app, our designers wanted the user to receive maximum information at any given moment. Even before the user starts filling out the claim, they can get detailed instructions on each step of filing an insured event. The app will advise what actions are required from the client, and will offer to contact the insurance company: by phoning call center, summoning a claim surveyor or tow truck, or emailing the tech support.

If the user selects the "Claim" option, the service begins processing the insured event. First, the app specifies the client's personal details. If this information is already stated in the profile, the app will insert it automatically Personal details can also be recognized via the smartphone camera. The app provides visual cues on how to position the passport and driving license in front of the camera to make the data readable.

VSK clients who bought the insurance not through the app, but in the office, can transfer it into the app. The product is integrated with the Адакта system which stores data on all VSK clients. This database provides data on the offline certificate so the client doesn't have to search for the paper version. If the user cannot submit their data, they can contact tech support. In this case the app will prepare an email template that will automatically include the following details: the name, phone number, region, and the user’s device’s specs.

To make it simpler for the person to describe the car damage and attach photos in the required format, the designers created an interactive visual scheme where one can mark the damaged parts. Up to nine sectors can be selected.

User data is constantly saved so the process can be paused at any moment. The claim will be saved as a draft, and the client is able to continue at a convenient time. And thanks to the online store integration, the filing process can be started on a smartphone, and completed on the VSK website.

After the claim is submitted, it is processed by VSK staff. The user can check the claim's status on its card: the appeal is registered with a case number; the appeal is accepted for review; the car is awaiting an inspection; documents are pending; a repair authorization has been sent to the service station; the repairs are complete.

The user can add or replace the documents and photos after having submitted the appeal. Thus, the company can obtain additional information required to learn more on the insured event.

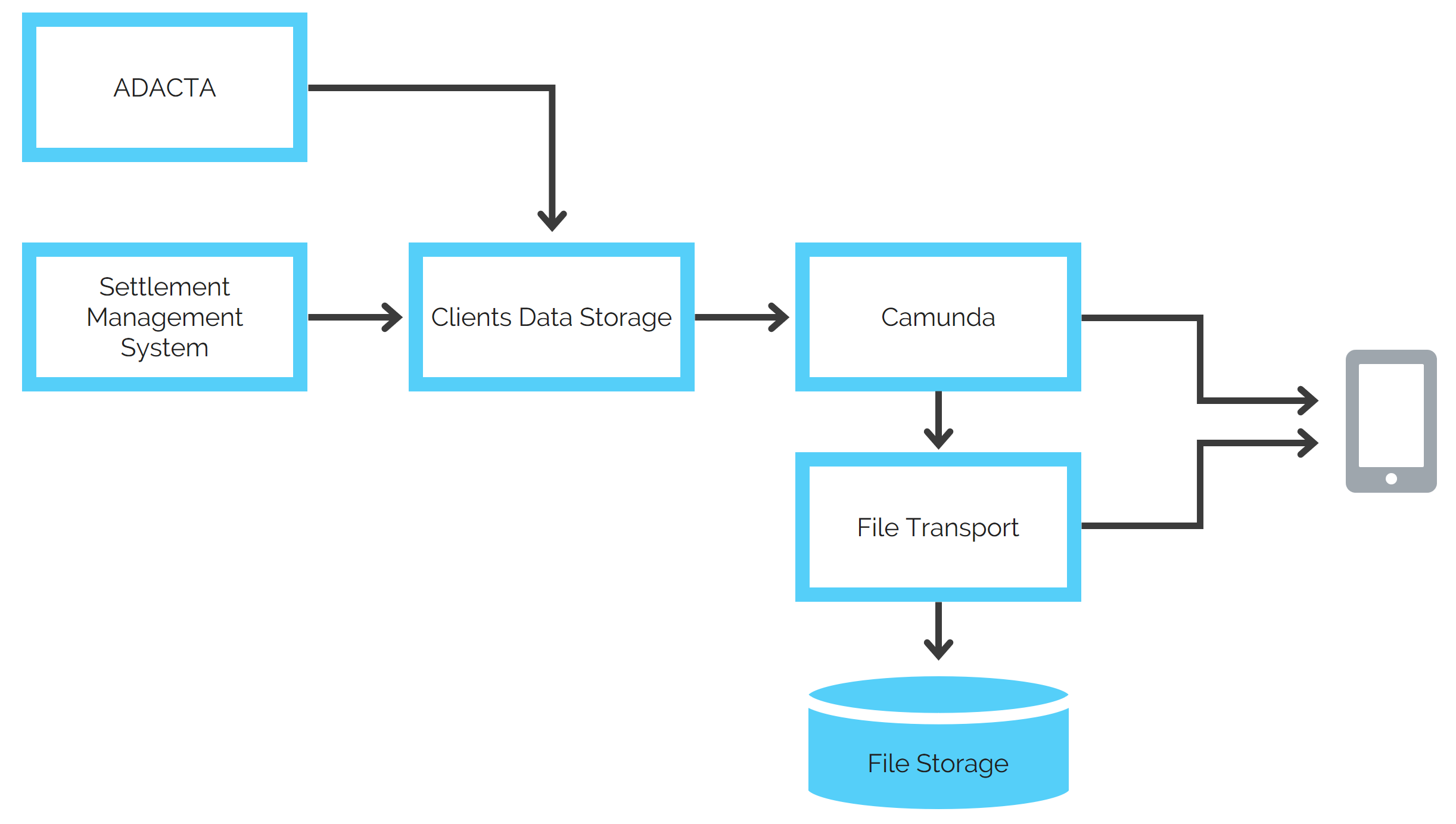

Solution architecture

- ADACTA – an insurance storage with the information about all the policies

- Settlement management system – allows VSK settlement specialists to work with the clients’ applications and carry out decisions

- Clients data storage – contains profile data, lists of policies, any other information about any given client

- Camunda – a business process management module, manages the business logic of the service (sends to the application information about the possible next steps, loads available policies and documents)

- File transport – sends data to the storage

The VSK comprehensive car insurance remote settlement service received an award at the Innoins-2020 Insurance Innovations Forum. According to the company, by mid-2020, 25% of all insurance claims were submitted by clients online. By the end of the year, VSK expects 50% of comprehensive car insurance appeals to be registered remotely, and the average monthly number of active mobile app users to grow by more than 45%.