How IngoMobile transferred comprehensive car insurance and third party liability insurance loss settlement onto the web

Claim settlement is always a stressful situation. For Ingosstrakh clients, this process has become simpler thanks to them being able to resolve all issues via the IngoMobile app. The service frees them of the burden of having to go to an office and guides them stepwise through all the stages of the process — from preparing an application to a repair shop referral.

IPJSC Ingosstrakh is one of the major insurance companies of Russia, insurance public joint-stock company. Headquartered in Moscow, Russia. Ingosstrakh's services are available everywhere in the Russian Federation thanks to its wide regional network, which includes 83 branches. The Company's offices operate in 220 Russian cities. IngoMomile is the official app providing Ingosstrakh's clients with full range of insurance services.

The insured event settlement application function appeared on the IngoMobile mobile app in spring 2020. From April to August 2020, Ingosstrakh clients claimed up to 75% of comprehensive car insurance losses and about 50% of third party liability insured events via the app.

Launching remote third party liability insurance settlement in the mobile app, the True Engineering team and Ingosstrakh finalized the full cycle of online sales and aftersales services for car insurance. Through IngoMobile, clients buy and renew their comprehensive car insurance and third party liability insurance certificates, register insured events, draw claims for loss settlement, and get referrals to repair shops.

In this article, we discuss how we completed the task of implementing online car insurance settlement, and what difficulties we tackled along the way.

Comprehensive car insurance

In 2018, we opened a remote comprehensive car insurance settlement service for Ingosstrakh clients. This was totally novel for the Russian market, a true landmark event. Our developers, along with the client's specialists, transformed a long and complex process into a chain of simple steps that one can complete within but a few minutes.

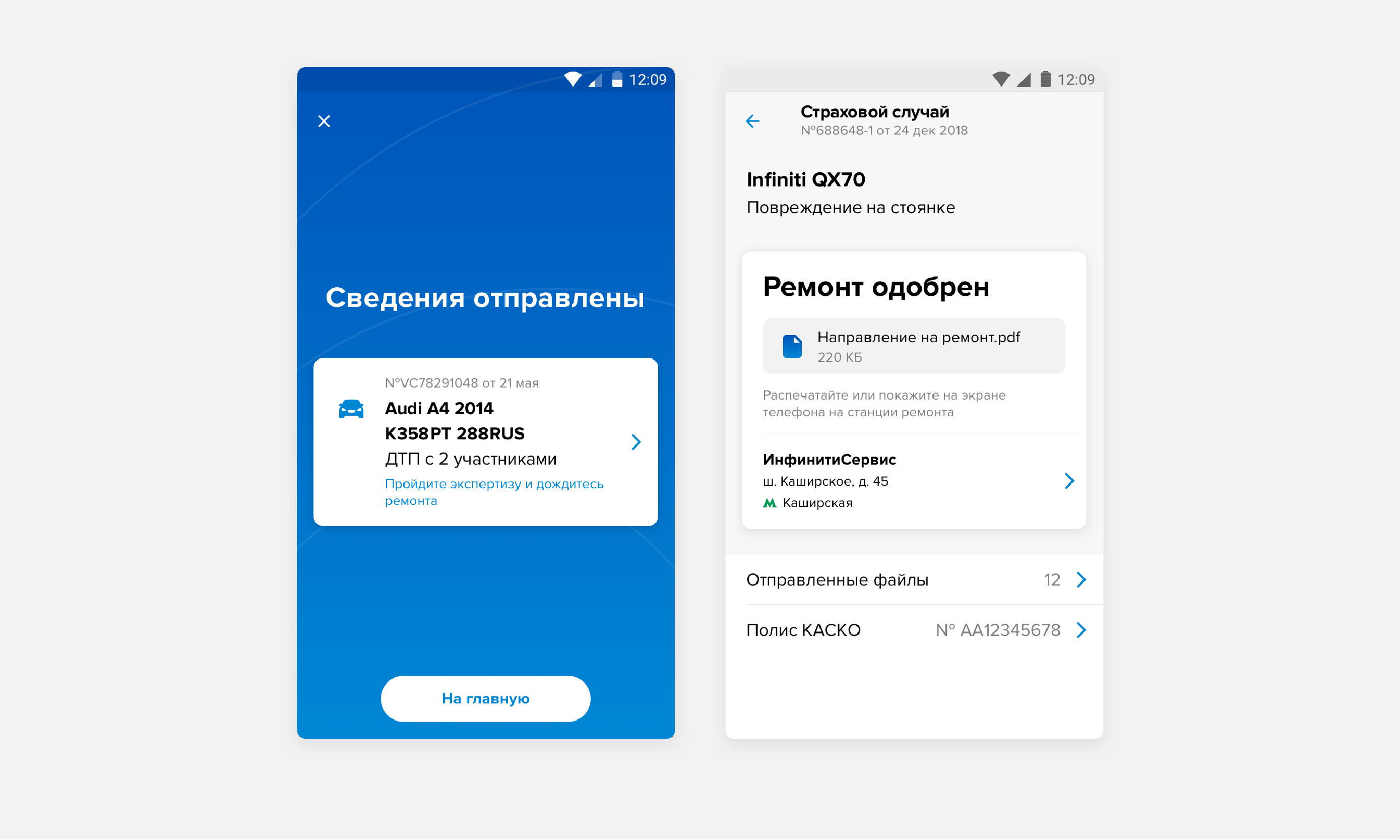

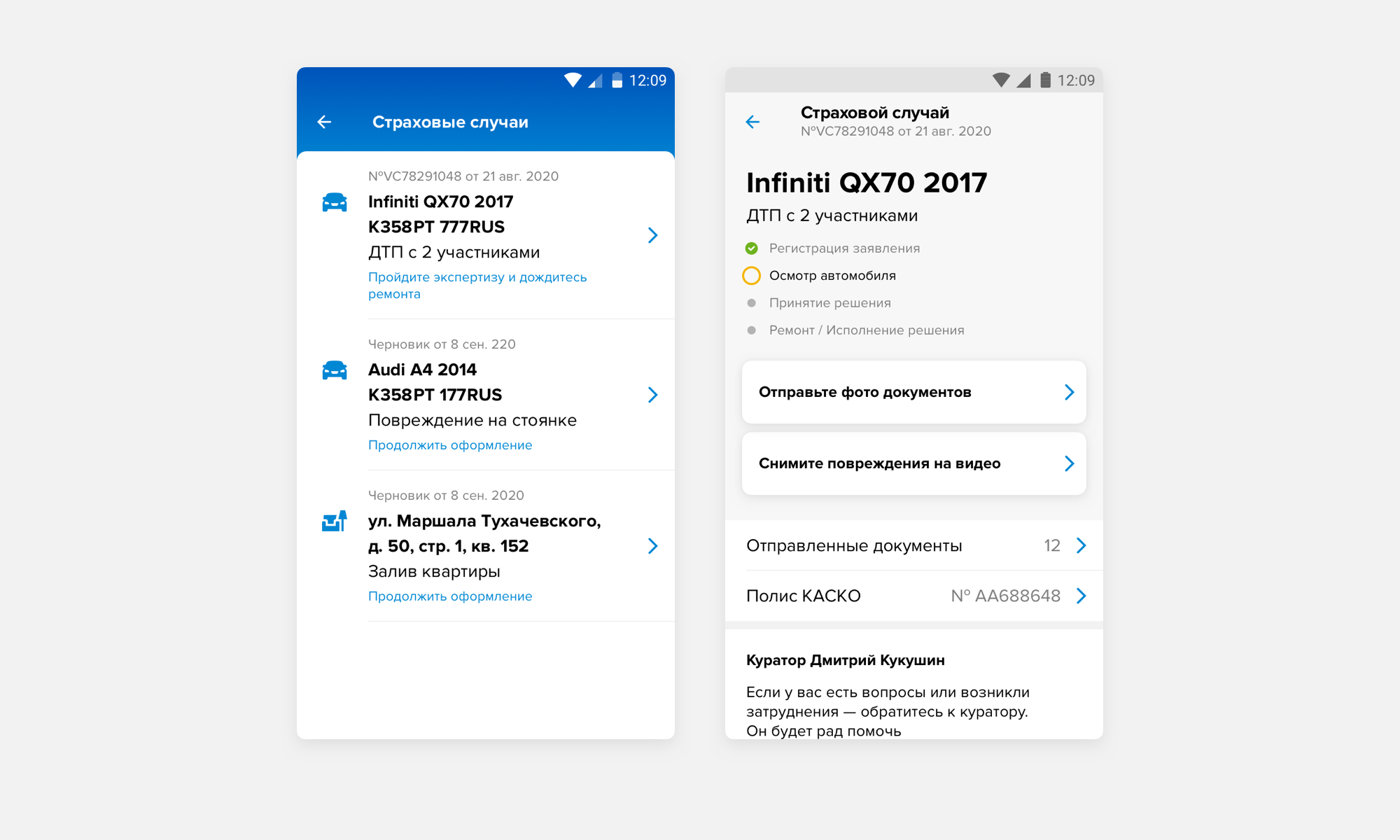

Ingosstrakh clients no longer had to negotiate with the company, nor bring paper documents to an office to register an application, and wait for a decision. Now users fill in the accident data themselves, attach a photo of the damaged car, choose a convenient service station from which to get a damage report and arrange the repairs. Then Ingosstrakh staff review the application, decide on any compensation, issue a referral for repairs or start the material compensation process. The whole process is handled by the app — clients can view their application status and check what steps lie ahead.

Extended third party liability insurance settlement — for the first time in Russia (again)

With third party liability insurance, things are a wee bit more complex - unlike comprehensive car insurance, this insurance type is regulated by a whole array of legislative acts, provisions, decrees and orders. So, our developers, along with the client's specialists, had to reflect all these legislative norms in the scenario.

Moreover, in order for the app to be able to settle any car accidents via the European Accident Statement, the system must be able to exchange data with the Russian Association of Motor Insurers. They store data on Russian drivers' insured events and serve as a "source of truth" in the third party liability car insurance processes. Insurance companies request this information from RAMI when they process their clients' claims.

For users, these complexities should be concealed behind clear and simple instructions. Our team set a goal to create a convenient service which does not oblige IngoMobile users to plunge into legal technicalities to solve their problems. We created such a service, again being the first on the Russian market.

Integration with Russian Association of Motor Insurers

RAMI provides us data on car accident registration numbers, and incident identifiers in the organization's database. Normally, they obtain such data from the traffic police when the officers register an incident. If those involved in an automotive incident draw a European Accident Statement, they have to do it by themselves via the RAMI application.

In the past, no other options existed but now Ingosstrakh clients need take no additional actions - everything can be done via IngoMobile. The app requests information on the client's insurance certificate from RAMI, then returns the incident data to the database. The incident is assigned a record number in the RAMI database, which is then used in claim settlement.

Two products, one scenario

Though comprehensive car insurance and third party liability insurance are two different products with different life cycles, such a distinction makes no sense for users - in both cases they just want the same outcome, namely settling their losses.

Thus, on IngoMobile, both settlements are based on the same scenario. Moreover, if the user completes the process once, no matter with which insurance certificate, then next time they will be able to submit an application in a semiautomatic mode.

App that’ll help

IngoMobile is akin to a friend who majored in Law. It will clarify all the incident details, explain what has to be done, what documents need filling l out, and how the procedure is organized. All internal logic - where the settlement application goes, and which department processes it, is hidden from the user. The latter only cares if there is a "Report an incident" button which will solve the problem.

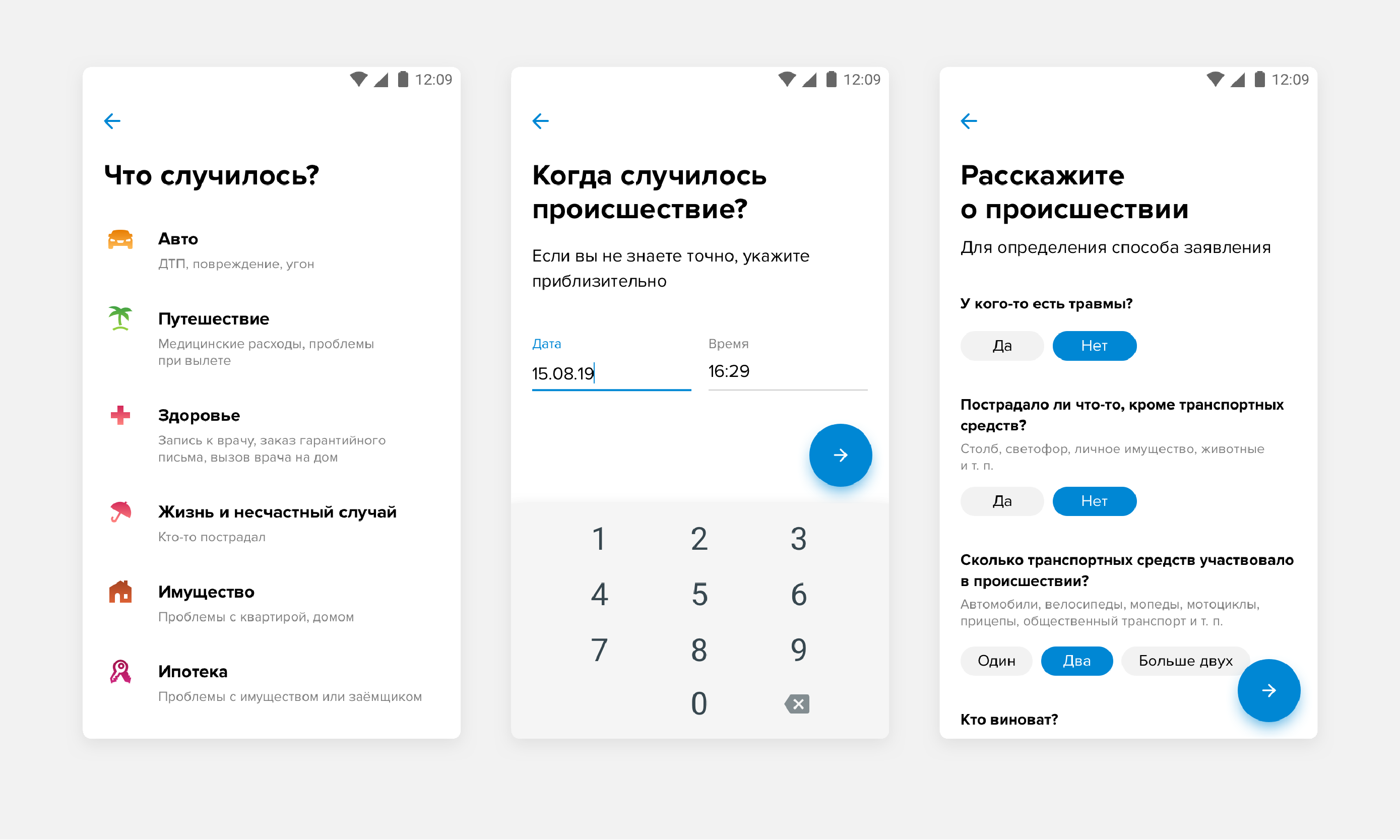

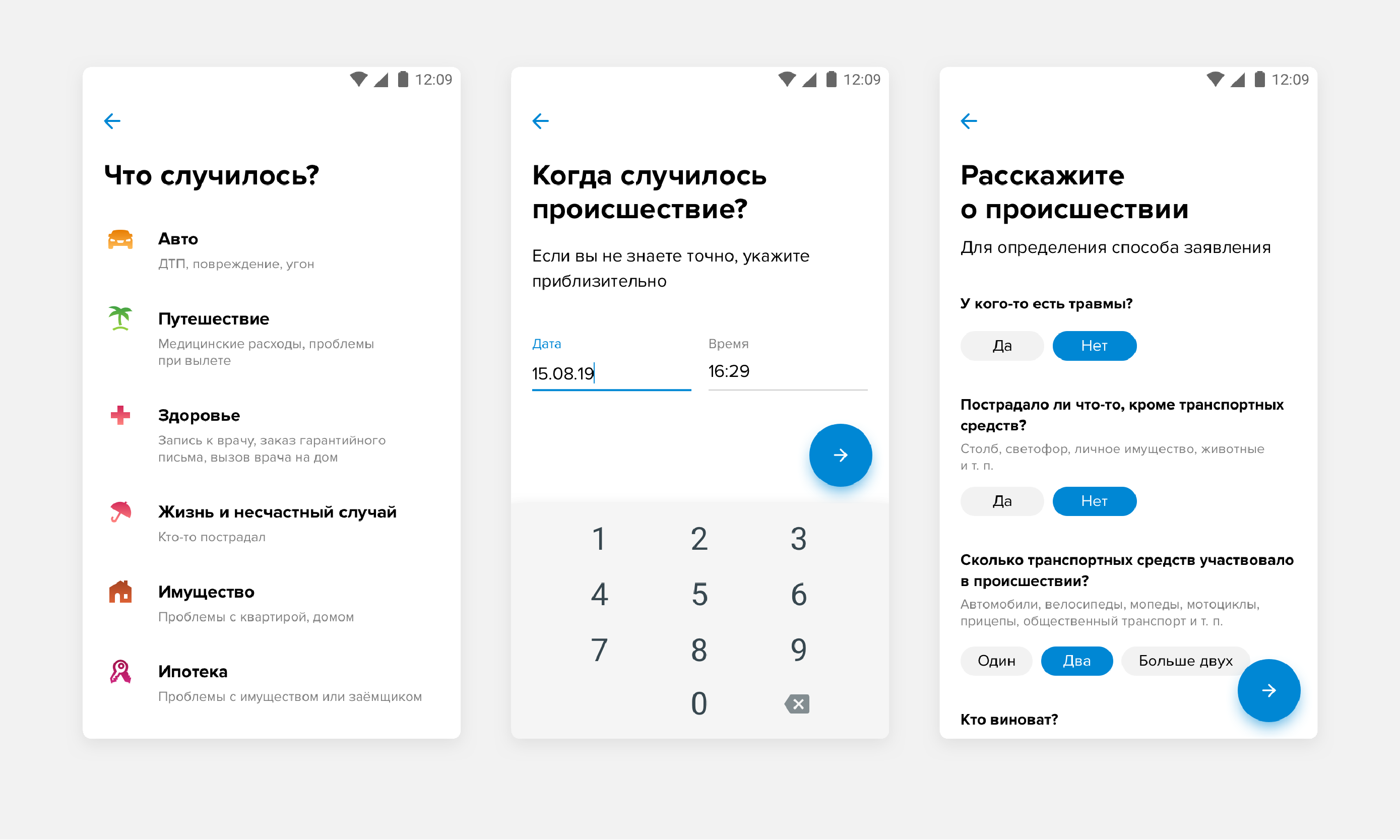

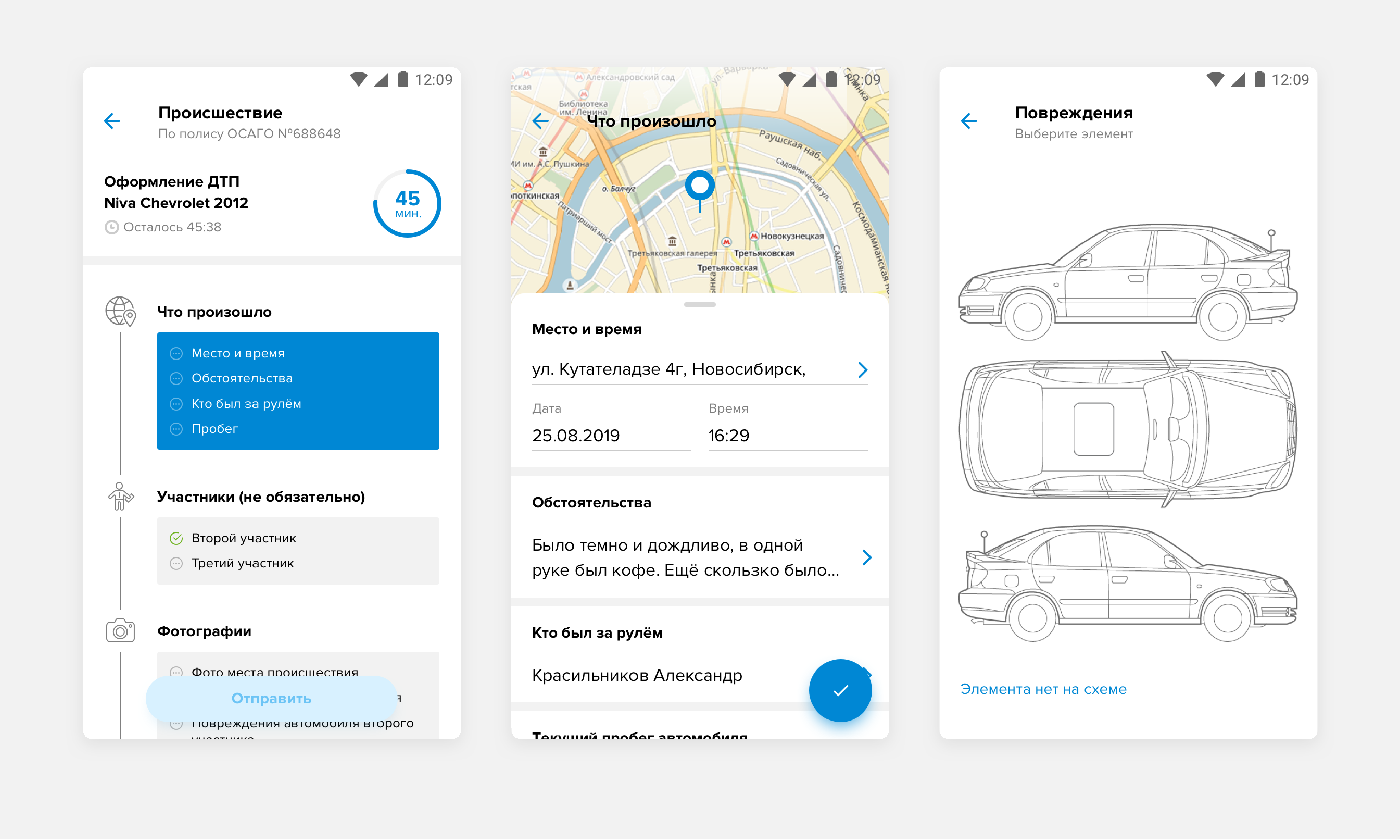

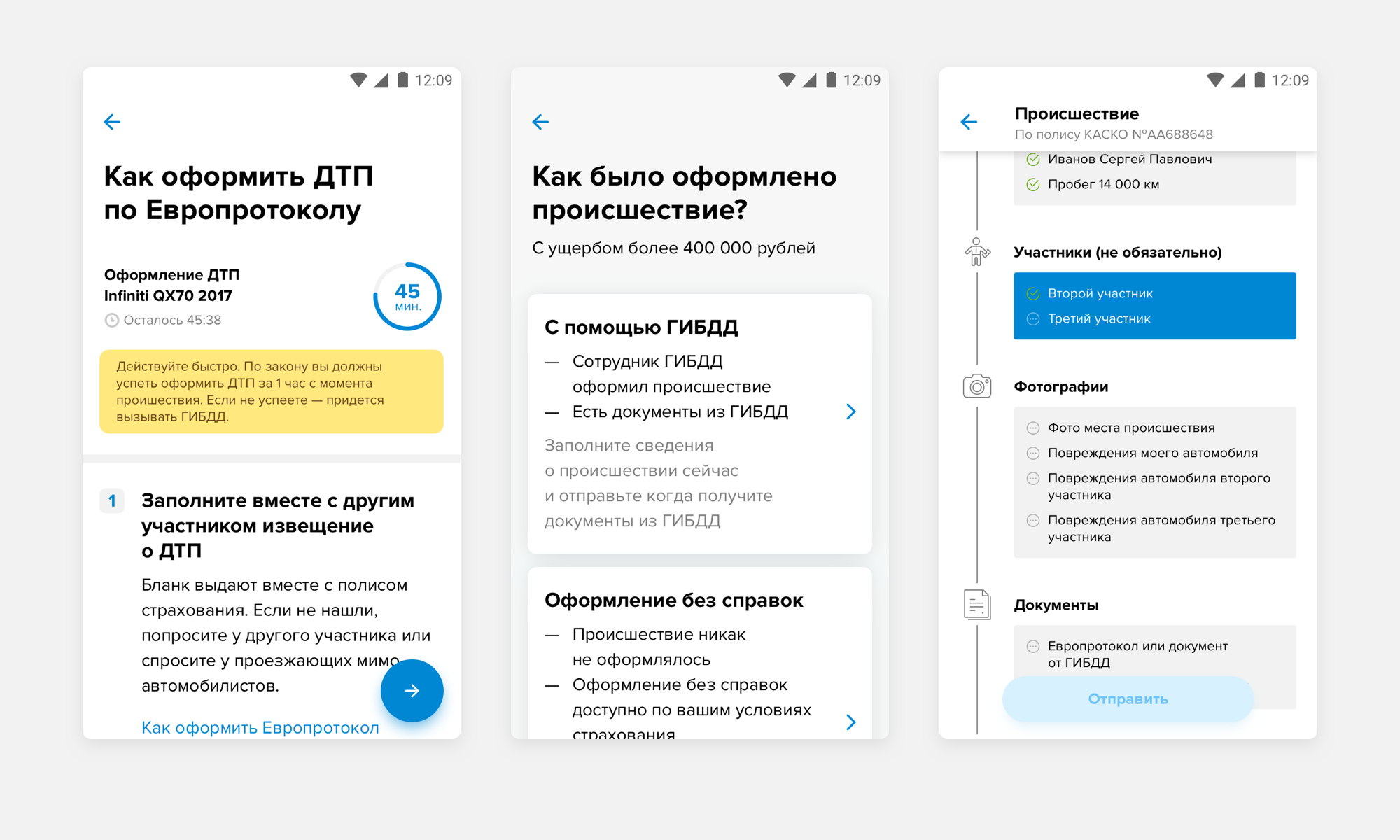

The client specifies the incident details: when it happened, how many people are involved, who is the culprit.

The app offers several ways to register the incident. Detailed tips are given at each step.

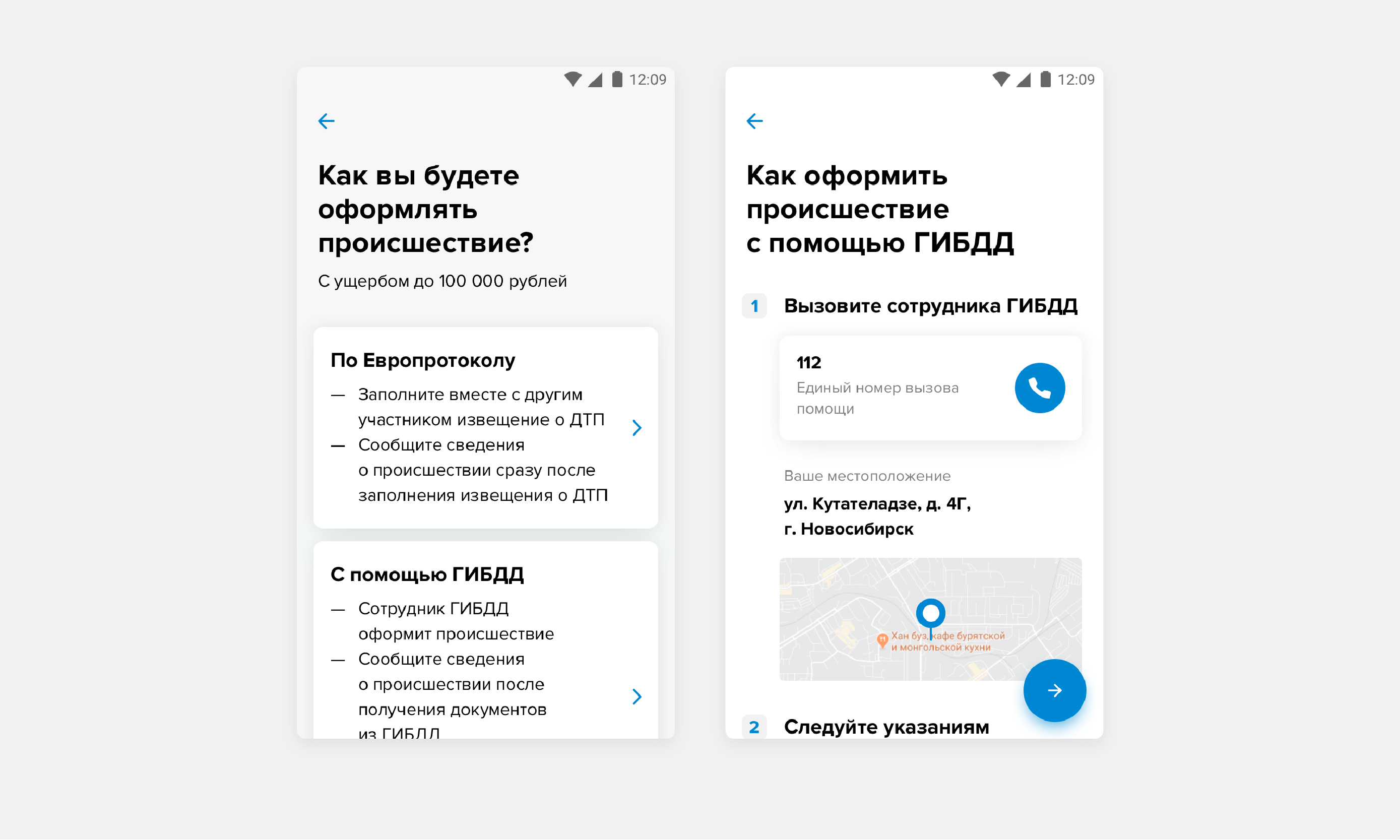

The client books the incident, describes the details in the app, takes photos of the damage, and selects a car service.

The client sends all the data to the insurer and waits for a referral to repairs. Ingosstrakh staff checks the data, requests clarifications if necessary, and appoints a service station.

Scenario adapts to request

On IngoMobile, all the scenario stages, each definition, and request, serve the same purpose — to make the settlement as simple and clear as possible. The settlement scenario adjusts automatically to the data the user provides there and then.

For instance,

- If a client wants to register an incident under the extended European Accident Statement with coverage of up to 400 000 rubles, the app warns that it must be done within an hour from the moment of the incident, and delays can affect the settlement outcome.

- If at the very first step you estimated the damage at more than 400 000 RUR, or indicated that there are more than two participants in the accident, the European Accident Statement option will be unavailable from the beginning.

- In case of a comprehensive car insurance settlement, the second participant's third party liability insurance certificate doesn’t have to be specified.

We made it so that a complex settlement scenario that includes many forks is guised in a basic questionnaire with understandable wording. The process still depends on various details; there are still some cases where a client will have to go to a office. Yet the client never loses control over the situation, and even if an issue cannot be resolved in the app, they will receive an exhaustive recommendation on how to proceed.

File an application in 30 mins

To fill out an application, attach the documents and photos of the car, 30 minutes are enough. Then clients can track their appeal status in the app. The event appears in the insured event list, and its card shows the whole chain of stages, so one can see at what step the process is now and who in Ingosstrakh can be addressed with questions.

Grand total

IngoMobile became the first insurance app in Russia to provide clients a full service cycle. Today, IngoMobile is a fully-fledged mobile insurance office where one can buy and renew cetificates, report insurable events and settle losses, and receive professional assistance from insurance experts. The app provides access to the main company products for private entities: comprehensive car insurance, third party liability insurance, property insurance, etc.

By the mid 2020, the app's audience had exceeded 210 000 users.

iOS app

Android app